Federal Income Support Programs

Canada Workers Benefit (CWB)

A refundable tax credit designed to provide income support to low-income individuals and families who are working. It includes a basic amount and a disability supplement. Eligibility is based on adjusted family net income and residency.

Learn more at CRAGST/HST Credit

A tax-free quarterly payment that helps individuals and families with low and modest incomes offset the Goods and Services Tax/Harmonized Sales Tax (GST/HST) that they pay. You are automatically considered when you file your tax return.

Learn more at CRACanada Housing Benefit (CHB)

A joint initiative between the federal government and provinces/territories to help make housing more affordable for Canadians in need. The benefit structure and eligibility can vary by province due to co-delivery models.

Learn more at CMHCCanada Child Benefit (CCB)

A tax-free monthly payment made to eligible families to help them with the cost of raising children under 18 years of age. The CCB may include the child disability benefit and any related provincial and territorial programs.

Learn more at CRAOld Age Security (OAS) + GIS

OAS is a monthly payment available to most Canadians aged 65 and older. The Guaranteed Income Supplement (GIS) provides an additional monthly payment to OAS recipients who have a low income and reside in Canada.

Learn more at Service CanadaProvincial & Local Support Programs

Provincial Income Support

Provinces offer their own income support programs. Examples include Ontario Works (OW), Alberta Income Support, and BC Employment and Assistance. These programs provide financial assistance and employment support to those in need.

Ontario Trillium Benefit

A combination of the Ontario energy and property tax credit, the Northern Ontario energy credit, and the Ontario sales tax credit. It helps Ontario residents with low to moderate incomes.

Learn more at Ontario.caSocial Housing Programs

These programs provide affordable housing options to low-income individuals and families. Managed at the municipal or regional level, they often involve housing subsidies or direct provision of units.

Learn more at Canada.ca (Housing)Utility Bill Assistance

Many provinces and local municipalities offer programs to help low-income households with their electricity, gas, and water bills. These can include energy rebates or emergency financial support.

Example: Ontario Utility SupportHow to Apply & Eligibility

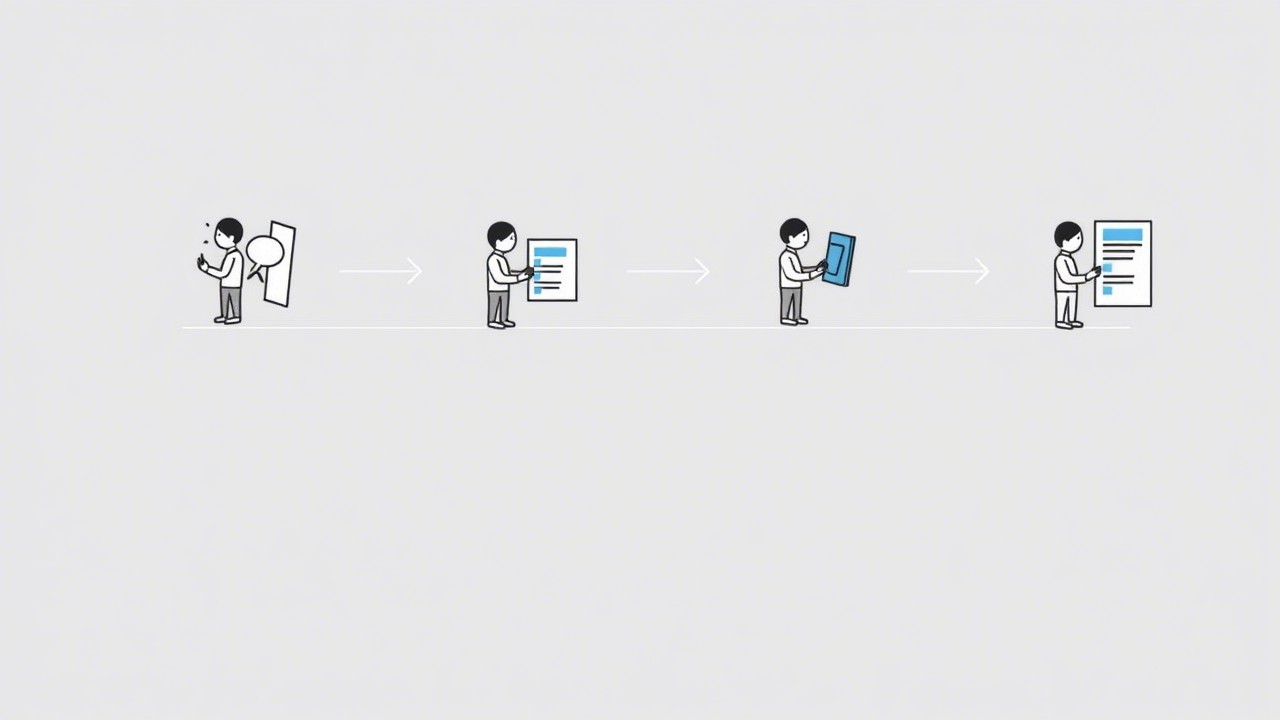

Understanding the Process

Applying for income support in Canada requires careful attention to detail and understanding of eligibility criteria. Each program has specific requirements, but common threads involve income levels, residency status, and providing accurate documentation.

- Basic Income Requirements: Most programs consider your adjusted family net income from your tax return. There are specific income thresholds for each benefit.

- CRA Notice of Assessment (NOA): Your NOA is crucial for verifying your income and is often required for benefit calculations. Make sure to file your taxes annually to receive this document.

- Online/Offline Forms: Many applications can be completed online through government portals (e.g., My Account on CRA, Service Canada Account) or by mail. Some programs may also require in-person visits to Service Canada Centres or provincial offices.

- Direct Deposit vs. Cheque: Opting for direct deposit is highly recommended for faster and more secure payments. You'll need your bank information ready.

Documents You'll Need

Having the right documents ready will significantly speed up your application process. Here's a general list of documents you might need for various federal and provincial income support programs:

Social Insurance Number (SIN)

Your nine-digit SIN is essential for most government programs and benefits.

Proof of Income

This includes your CRA Notice of Assessment (NOA), T4 slips, pay stubs, or other income statements.

Bank Information

For direct deposit: void cheque, direct deposit form from your bank, or bank statement with account details.

Rental Agreement / Proof of Address

Required for housing-related benefits or to confirm residency.

Identification (ID)

Government-issued ID such as a driver's license or provincial ID card.

Child's Birth Certificate (for CCB)

If applying for the Canada Child Benefit, proof of your child's birth is required.

FAQ: What to Do If Denied / Delayed

If your application is denied, carefully review the reason provided in the denial letter. You typically have the right to request a reconsideration or appeal the decision. Gather any additional documentation that supports your case and contact the relevant government agency (e.g., Service Canada or your provincial social services office) for guidance on the appeals process. They can provide specific forms and timelines for reconsideration.

Before reapplying, ensure you understand why your previous application was unsuccessful. Address any missing information or eligibility issues. If your circumstances have changed (e.g., income decrease, new family member), you might become eligible. Follow the same application steps, making sure all information is accurate and complete based on your current situation.

For federal benefits (like CCB, GST/HST Credit, OAS/GIS), you should contact Service Canada or the Canada Revenue Agency (CRA). You can find contact numbers on their official websites. For provincial benefits, look for the contact information on your province's specific program page (e.g., Ontario Works, Alberta Income Support). Have your SIN and application details ready when you call.

What People Are Saying

"MapleSupport made understanding the benefits process so much easier. The clear explanations and links to official sources saved me hours of searching!"

- Sarah L., Toronto, ON

"As a newcomer, I was overwhelmed. This site cut through the jargon and helped me identify the programs relevant to my situation. Highly recommend!"

- Omar K., Vancouver, BC

"The guide I received after subscribing was incredibly detailed. It's truly a complete checklist for navigating support programs in Canada."

- David P., Calgary, AB

Unlock Your Free 2025 Guide!

Subscribe to receive your copy of the "Complete Low-Income Support Checklist 2025" PDF guide. Get the essential details you need, delivered directly to your inbox.